BY ANTHONY OMOH

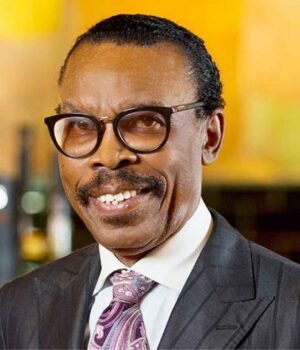

A whopping ₦3.5 billion in lost revenue and continued traffic decline have exposed deep cracks in aviation sector financing in Nigeria. This was the central warning issued by Managing Director Financial Derivatives Company, Mr. Bismarck Rewane, during the 2025 League of Airports and Aviation Correspondents (LAAC) Conference in Lagos.

Rewane, speaking on the theme “Aviation Financing in Nigeria: Risks, Opportunities and Prospects,” drew attention to data showing that from 2020 to 2022, Nigeria’s aviation industry lost billions due to poor infrastructure and a fragmented operational model. He stressed that fixing aviation sector financing in Nigeria is not optional, it is critical to national progress.

Fragmentation Is Bleeding the Industry

Nigeria has 32 airports, yet only four handles between 92% and 96% of total traffic. The domestic passenger volume dropped to 11.5 million in 2024, marking the second straight year of decline.

Rewane blamed this on inefficiency, over-politicisation, and poor project viability. “We are duplicating infrastructure while traffic shrinks,” he noted. “The truth is, aviation sector financing in Nigeria is being driven by prestige, not performance.”

Comparative Stats Show Misalignment

Lagos’ Murtala Muhammed International Airport processed 6.5 million passengers in 2024 with an estimated $1.75 billion investment. In contrast, Dubai International handled 92 million passengers with $4 billion. Also, in the same period Los Angeles International Airport had a staggering 76.5 million passengers investing $3.5 billion. Heathrow and Chicago’s O’Hare International both had 83.9 and 58 million passengers investing $15.6 and $4.5 billion respectively.

“Why should we spend so much and get so little?” Rewane asked. “This misalignment highlights systemic issues in aviation sector financing in Nigeria that can no longer be ignored.”

State Airlines and Airports: Vanity Projects?

Rewane noted that several state-backed ventures including airlines like Enugu Air, Cally Air, and the defunct Air Nigeria, represent failed experiments rooted in mismanagement and political interference. According to him, all launched despite viability concerns. “These projects are capital-intensive and inherently risky. Without autonomy and proper structuring, they drain public coffers with little or no return,” he said.

“Several states are building airports with no passenger base to justify the cost. This is a misapplication of scarce resources and a poor model for aviation sector financing in Nigeria,” he said.

The Financial Derivatives CEO compared Nigeria with California to illustrate how misaligned investment in aviation can stifle development. California, he noted, handles over 600,000 passengers daily across 25 airports, while Nigeria manages barely 43,000 with 32 airports. “This mismatch is symptomatic of the deeper issues with aviation sector financing in Nigeria, poor capital allocation, inefficient spending, and lack of economies of scale,” he said.

Global Trends and Local Contradictions

Rewane presented global trends in aviation that emphasise profitability, consolidation, and alliances. He cited the rise of bundled services, joint ventures, and open skies agreements as strategic tools that have driven efficiency elsewhere. “Airlines globally are becoming leaner and smarter. Profit margins are at 3.7%, and major players are evolving through code-share deals and mergers,” he stated.

In contrast, aviation sector financing in Nigeria continues to be weighed down by state obsession with ownership rather than enabling frameworks. He argued that rather than building new airports or state airlines, efforts should be concentrated on policies that incentivise private investment and reduce regulatory bottlenecks.

“Government should not be in the business of running airlines or building airports,” he said. “Its role must focus squarely on regulation, safety, and creating an environment for capital to thrive.”

PPPs and Consolidation: The Way Forward

To move forward, Rewane called for a competitive hub system, particularly in Lagos and Abuja, backed by strong and independent regulators. “Airport concessions, MRO investments, and simulator training hubs should be driven by PPPs. This model has worked globally and can reframe aviation sector financing in Nigeria for long-term sustainability,” he said.

Rewane Calls for Strategic Aviation Hubs

To solve the problem, Rewane proposed consolidating air services around competitive hubs, starting with Lagos and Abuja. He noted that successful global carriers such as Ethiopian Airlines leverage hub efficiency, autonomy, and diversified revenue.

“We need fewer, stronger airports, not more underused ones. That’s how to structure sustainable aviation sector financing in Nigeria,” he advised.

Key Global Trends: What Nigeria Must Learn

Rewane urged local operators and policymakers to adopt global best practices:

-

Embrace mergers and strategic alliances (like Star Alliance and SkyTeam).

-

Prioritise bundled services (e.g., insurance, hotels, car hire).

-

Shift from bilateral air agreements to open skies.

-

Invest in training, safety, and local Maintenance, Repair & Overhaul (MRO) capacity.

These, he argued, are essential to recalibrating aviation sector financing in Nigeria in line with international expectations.

PPP-Driven Investment is the Future

Rewane underscored the role of public-private partnerships (PPPs) in unlocking capital and reducing government fiscal burden. He recommended:

-

Prioritising airport concessions.

-

Focusing government resources on regulation, not operations.

-

Ensuring consistent policy to attract aviation investors.

“All future plans for aviation sector financing in Nigeria must be anchored on transparency, autonomy, and investor confidence,” he concluded.

Global Air Travel Is Rising, Nigeria Risks Falling Behind

International arrivals are forecast to hit 1.538 billion in 2025, a record high. Yet Nigeria’s own sector shrank by 0.81% in Q1 2025, its sixth consecutive quarterly decline.

Without urgent reform, Rewane warned, Nigeria risks becoming irrelevant in global aviation. “We cannot afford business as usual. A revamp of aviation sector financing in Nigeria is no longer just necessary it is overdue.”